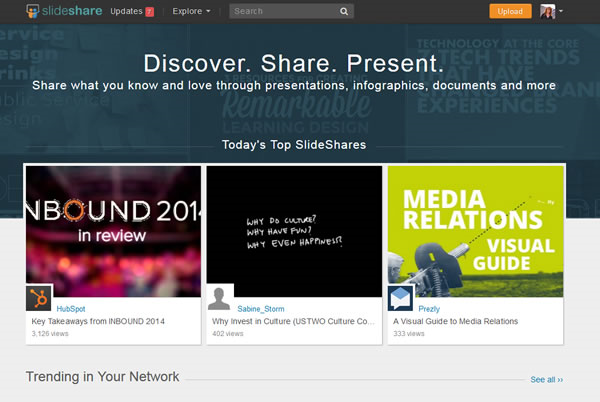

What is Slideshare?

SlideShare launched several years ago with the goal of share knowledge online. Since then, SlideShare has grown to become the world’s largest community for sharing presentations and other professional content.

How Does Your Business Benefit from Slideshare?

According to the SlideShare website:

SlideShare consists of more than 15 million uploads from individuals and organizations on topics ranging from technology and business to travel, health, and education. Share the content that matters to you with your colleagues, customers, friends and followers. SlideShares can be embedded into websites and blogs, and are easily shareable on LinkedIn, Twitter, Facebook, and other popular social media platforms. They can be viewed publicly and privately. Connect with other SlideShare users via comments, “likes,” and profile pages.

Have content, presentations, photo collections or expert knowledge on a topic?

Upload it to SlideShare and you'll reach a wide audience!

A few tips for making the most of your SlideShare marketing:

1. Use the lead capture capabilities of SlideShare (You have a couple options for this)

- If the viewer wants to download the original presentation, he/she is prompted to fill out a short contact form first.

- When the viewer is browsing the presentation, the contact form displays at an increment specified by you (on a specific slide, at the end, or via a button that's displayed throughout)

2. Upload White Papers to Showcase Your Expertise

SlideShare is more than PowerPoint. You can also upload documents, including PDFs. Why EVERY business doesn't take advantage of this feature is beyond us. It's simply another way to publish your information and make it easy for people to share. TIP: Be sure that you include your contact information on EVERY business piece you publish, as well as a call to action!

3. Promote Your SlideShare Content Across Other Social Channels

Don't stovepipe your marketing efforts across the social channels ... be sure to share and promote across all of them. Certain segments of your audience may only be on Facebook and may have never heard of SlideShare. If you aren't promoting your SlideShare channel on your business Facebook page, you could be missing an entire group of people.

4. Post your Presentations to LinkedIn

Add your SlideShare content to your LinkedIn profile summary page. LinkedIn has really become the go to platform for business to business marketing, network building, and reputation growing. Tying your SlideShare presentations to your LinkedIn profile can only enhance your credibility in your field.

5. Write "How To" Guides for your Area of Expertise and Share them on LinkedIn

People learn visually. Any time they need to know how to do something these days they Google it. This is a perfect combination for your business! A great "how to" guide featuring something in your service arena or area of expertise on SlideShare can be indexed by Google and findable by your prospects. This type of content is highly popular and very sharable.

6. Use audio in your slides

Did you know you can add voice-overs in PowerPoint? If it makes sense for your content, include a voice-over in your slides. When you upload the presentation to SlideShare, the voice-over stays with the presentation and can be listened to by anyone viewing it. Talk about powerful!

7. Embed Your SlideShare Presentations on your Website

When you upload a presentation to SlideShare, they offer you a nice little "widget" that you can send to your webmaster to add to your website. This literally embeds the presentation right on your website. Visitors don't have to leave your website to view the presentation. If you've added a lead generation form to the presentation in SlideShare, this carries over to the embedded presentation too.

Shhh ... it's a secret!

SlideShare is "best kept secret" of professional marketers ...but it's actually free for any business who wants to use it! Of course, there is a paid option available that unlocks additional features. We encourage you to check it out and use this powerful tool in your content marketing plan for your business! Visit their website at http://www.slideshare.net

About Novera Payment Solutions

Novera Payment Solutions is a leader in the credit card payments industry. We are committed to helping businesses improve their bottom line by providing significant savings on credit card processing fees through our innovative flat fee merchant account pricing model.

Contact Novera to learn more about how we work with businesses to provide the most fair and transparent pricing structure available on the market today!