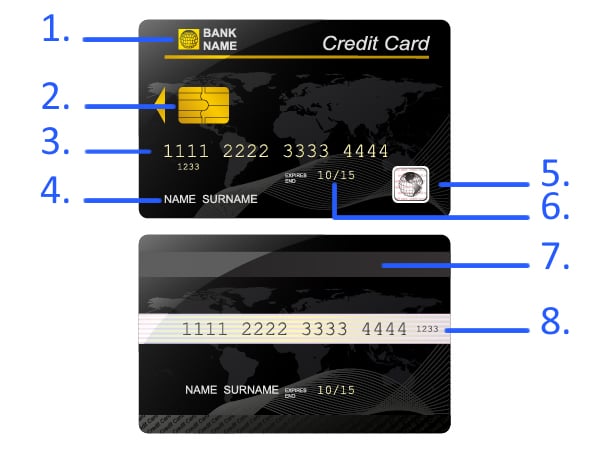

Just because we know you've always been curious about what all that "stuff" is on your credit card front and back, we thought we'd give a basic anatomy lesson. A few facts may surprise you, like did you know that VISA card numbers ALWAYS start with the number 4? Read on!

1. Bank Name

Typically a bank name appears at the top of your credit card. This represents the bank that is lending you money via the credit card transaction, not the company that processes the payments. For exmaple, your VISA or MasterCard will have a bank name at the top ... the bank is the entity lending the money and VISA or MasterCard is the processor.The exception is with American Express or Discover ... they are both the bank lending you money and the processor.

2. Computer Chip

The computer chip is being phased in to United States issued credit cards to improve security and reduce fraud. The credit cards containing chips are called EMV cards. EMV cards are more secure because the computer chip generates a unique code for every transaction you make, whereas the magnetic stripe has static data that can be stolen and re-used. During the phase in, cards will have both, the computer chip AND the magentic strip on the back, but ultimately the magnetic strip will go away.

3. Account Number

The account numer is made up from a series of complex algorithms and each series of numbers has very specific meanings. The details are way too much information to go into here. However, you may be interested to know that the very first number on the card is the "Major Industry Identifier." You can tell what kind of card it is from the first number if you know that all Visa cards start with a 4, MasterCards start with a 5, Discover cards start with 6, and American Express cards start with a 3.

4. Cardholder Name

Credit cards will also have the first and last name of the cardholder or the organization that is associated with the account. Online transactions typically require the name on the card to

exactly match the cardholder name as an added layer of security.

5. Hologram

The hologram displays a three-dimensional image on the two-dimensional surface. This was introduced to help prevent counterfieting of credit cards.

6. Expiration Date or Valid Thru Date

This indicates the last month and year the credit card can be used. Some banks include a day of the month, but typically it's just the month and year. The day (not shown) is the last day of the month.

7. Magnetic Stripe

Magnetic stripes on credit cards come in three colors colors black, brown or sliver. They have up to three tracks. The first two tracks contain the card holder data necessary to complete the transactions. With the new EMV credit cards, magnetic stripes will ultimately be phased out.

8. Signature Strip

Credit cards must be signed to be valid. When you sign the strip it gives businesses an extra tool to guard against fraud, because they can see whether the signature on the cardmatches the one on the receipt.

The signature stripe also includes the credit card security code (CVV or CIV code) on Visa and MasterCard cards. This also provides additional security against credit card fraud because you have to have the card in hand to see the code.

About Novera Payment Solutions

Novera Payment Solutions is a leader in the credit card payments industry. We are committed to helping businesses improve their bottom line by providing significant savings on credit card processing fees through our innovative and trasparent flat fee merchant account pricing models. We are confident we can save your business money on credit card processing fees!